November property market update

- Posted By Nikki Montaser

Continuing recent trends, the most recent data has demonstrated an overall rise in asking rents and a decrease in vacancy rates — further tightening the market. SQM Research predicts that the rental market strain may not ease until late 2023 at the earliest.

Vacancy rates

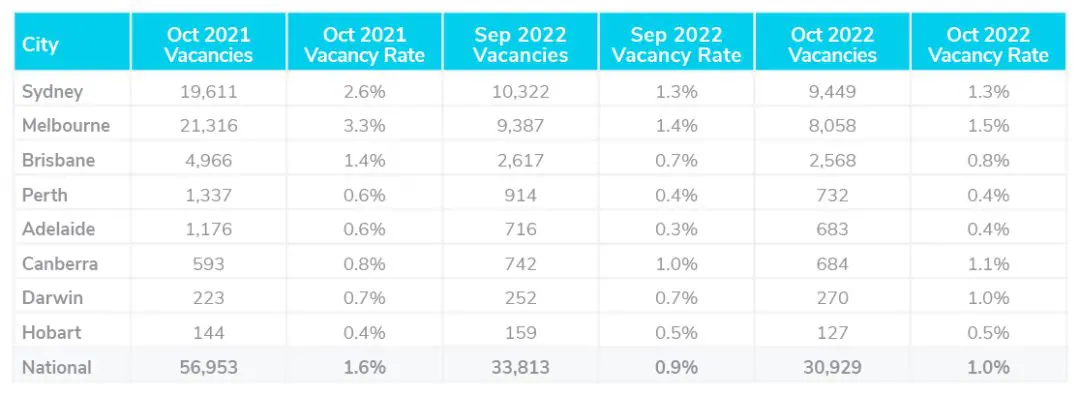

With an update to September’s vacancy rate data seeing it now recorded as revised 1.1%, October has revealed the lowest national vacancy rate of 1.0% with a total number of rental vacancies Australia-wide being 30,929 residential properties (a decrease from September’s 33,813).

Although overall Sydney, Melbourne and Canberra vacancy rates fell from 1.5%, 1.8% and 1.2% to 1.3%, 1.5%, and 1.1%, there was variance seen within the specific CBD precincts. Sydney CBD rose to 3.5%, while Melbourne CBD and Brisbane CBD fell to 2.6% and 1.2%, respectively. Darwin remained constant at 1%, and in the smaller capital cities, Brisbane, Perth, Adelaide, and Hobart, vacancy rates sat well below 1.0% over October.

For comparison, this time last year, there was a reported 10 year low (at that time) with the Australia-wide vacancy rate sitting at 1.6%.

An increasing number of regional townships and regions are bucking the trend, including Sydney’s Blue Mountains, Wollongong, NSW North Coast, Northern Victoria, and Gippsland.

Louis Christopher, Managing Director of SQM Research said, “The national rental market is still very much in favour of landlords, particularly for our capital cities where there is no evidence yet of any easing in the rental market.” He continued, “However there is some good news for tenants in a number of townships and regions outside the capital cities whereby SQM Research is now recording a consistent rise in rental vacancy rates, albeit from a very low base.”

Rental values

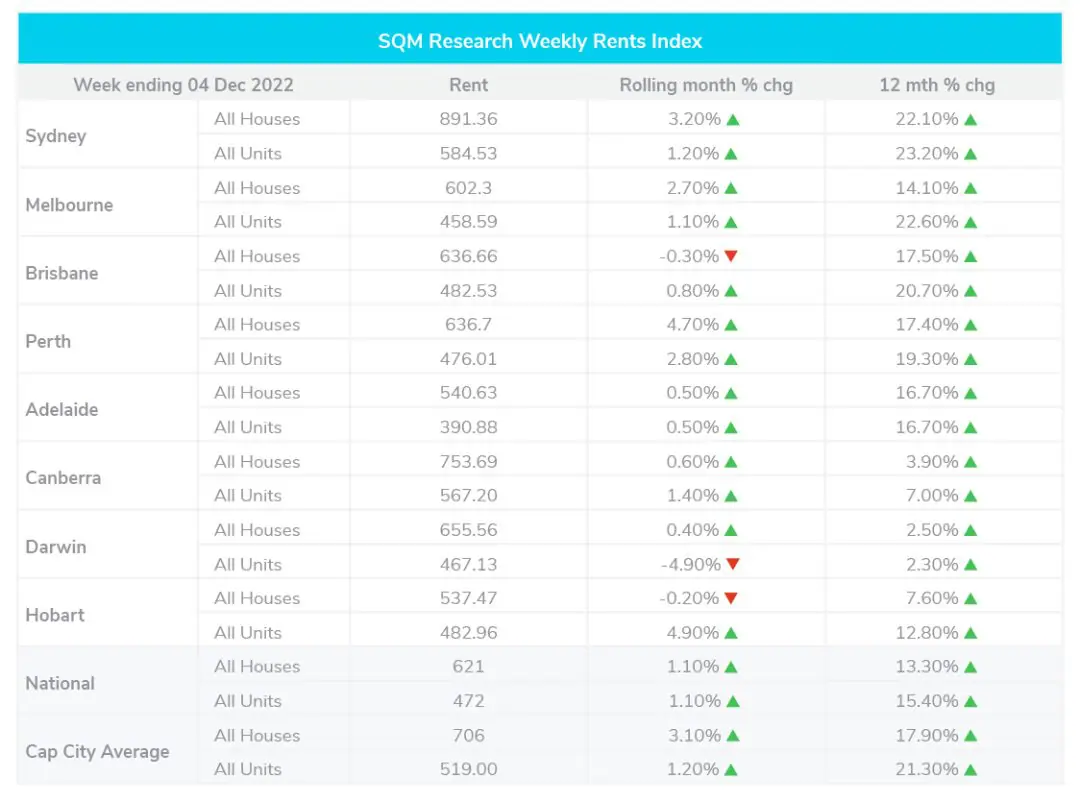

Australia-wide rental values increased 3.74% from the previous week, with an 18.5% 12-month increase. The national median weekly asking rent for a house is recorded at $621 per week, and a unit is $472. The capital city average sits at 24.4% for the 12-month increase, with $706 per week rent for a house, and $519 for a unit, with Sydney tracking at the most expensive across Australia at $891.36 per week for a house and $584.53 for a unit.

The rental crisis is not expected to be easing any time soon. Louis Christopher, Managing Director of SQM Research suggested the regional vacancy rate decrease and population flow back to the cities may be attributed to the number of workers being asked to go back into the office. Highlighting “if we are correct in this assessment, this means the capital city rental market will continue to be under great strain for tenants over the foreseeable future and may not ease until late 2023 at the earliest. And as we can see through the asking rent increases over the past 30 days, the capital city rental crisis remains with us to this day.”

Property prices

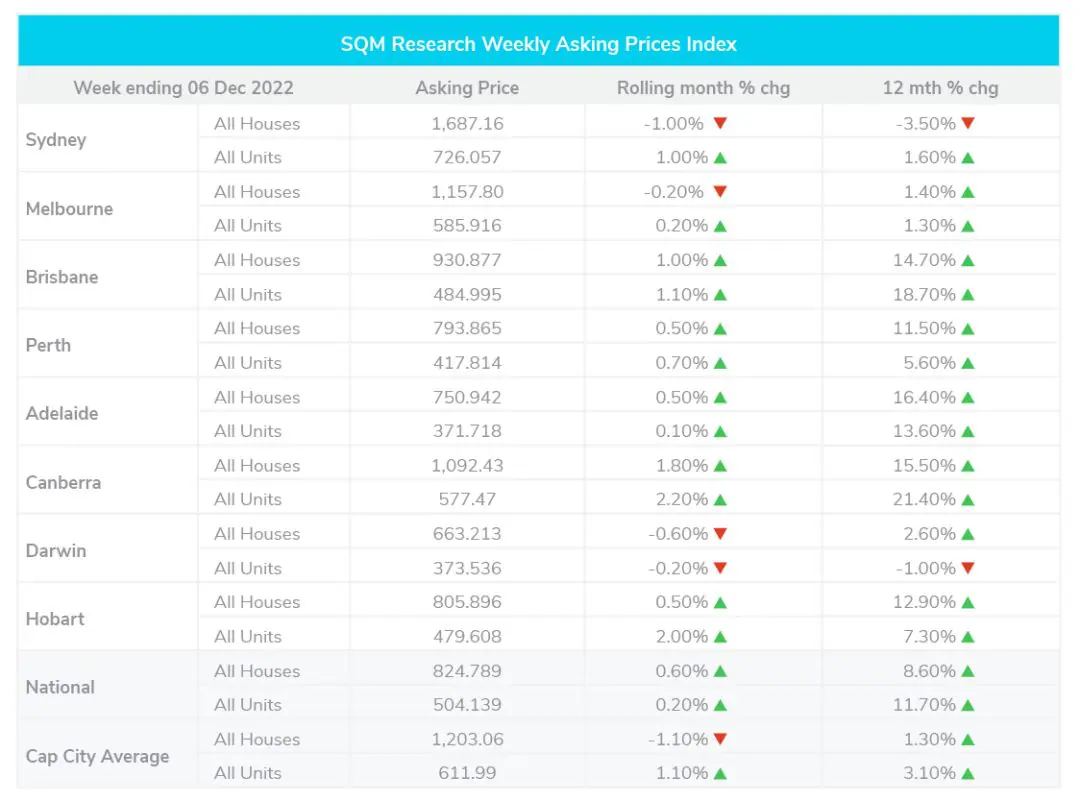

A combined capital city average sits at a 0.7% decrease for the past month, and a 0.5% decrease over the past 12 months, with mixed trends around the country contributing to a National increase in asking prices of 0.5% over the past month and 7.8% increase over the past 12 months.

The capital cities experiencing a decrease in asking prices over the past month include Sydney at a combined 0.5%, Darwin at 0.5%, and Melbourne at 0.3%. Increases in property asking prices over the past month were seen in Canberra at 2.0%, Brisbane at 1.0%, Hobart at 0.7%, and Adelaide and Perth at 0.6%.

Australia-wide in November, the number of new listings (Less than 30 days) rose 2.5% to 76,553 properties on the market. Louis Christopher, Managing Director of SQM Research said, “Listings are only 3.4% higher than 12 months ago, which is a small increase given the housing downturn… One of the key reasons why I was not more negative for the outlook on housing for 2023 was because stock listings have remained relatively stable. There is nothing in today’s numbers which changes my mind on that.”

Cash rate and predictions

The RBA has raised the interest rate an additional 0.25 basis point, to a target cash rate of 3.10%, increasing the cash rate to its highest point since November 2012.

Article posted by Property Me.