December property market update (2022)

- Posted By Nikki Montaser

The national vacancy rate in November remained unchanged at 1%. While the CBD Market has returned to more normal levels of occupancy and an easing in some regional areas has been seen, nationally weekly asking rents continued to increase over the past month at 1.6% for houses and 2.3% for units.

Vacancy rates

While the national vacancy rate remains steady at a tight 1% in November; Sydney, Canberra, and Darwin vacancy rates rose from 1.3%, 1.1%, and 1% to 1.4%, 1.4%, and 1.2%. Melbourne remained steady at 1.5% and in the smaller capital cities, Brisbane, Perth, Adelaide, and Hobart vacancy rates sat below 1% in November.

The CBD rental market has returned to more normal levels of occupancy or just below long-term average levels with vacancy rates in the Sydney CBD and Melbourne CBD falling to 3.2% and 2.5%. Brisbane CBD rose to 1.4%.

An easing in regional areas that previously recorded extremely tight rental conditions, has provided some relief for tenants. Sydney’s Blue Mountains where the vacancy rate has risen from a record low of 0.5% recorded in March 2022, to now stand at 1.5%. Some other regions recording an easing in conditions include NSW North Coast, Gold Coast North, Ipswich, North Queensland, Gippsland, and a number of outer ACT localities.

Louis Christopher, Managing Director of SQM Research said, “The immediate outlook is ongoing extreme tightness in the rental market. February/March tends to be a very seasonally difficult time for tenants looking for rental properties and given the already low rental stock on the market, early 2023 could be a nightmare for would-be tenants.”

He continued, “However, there might be some light at the end of a very long tunnel given expected rises in dwelling completions over 2023 and a possible return of short-term leased properties back into the long-term market if the economy does cool.”

Rental values

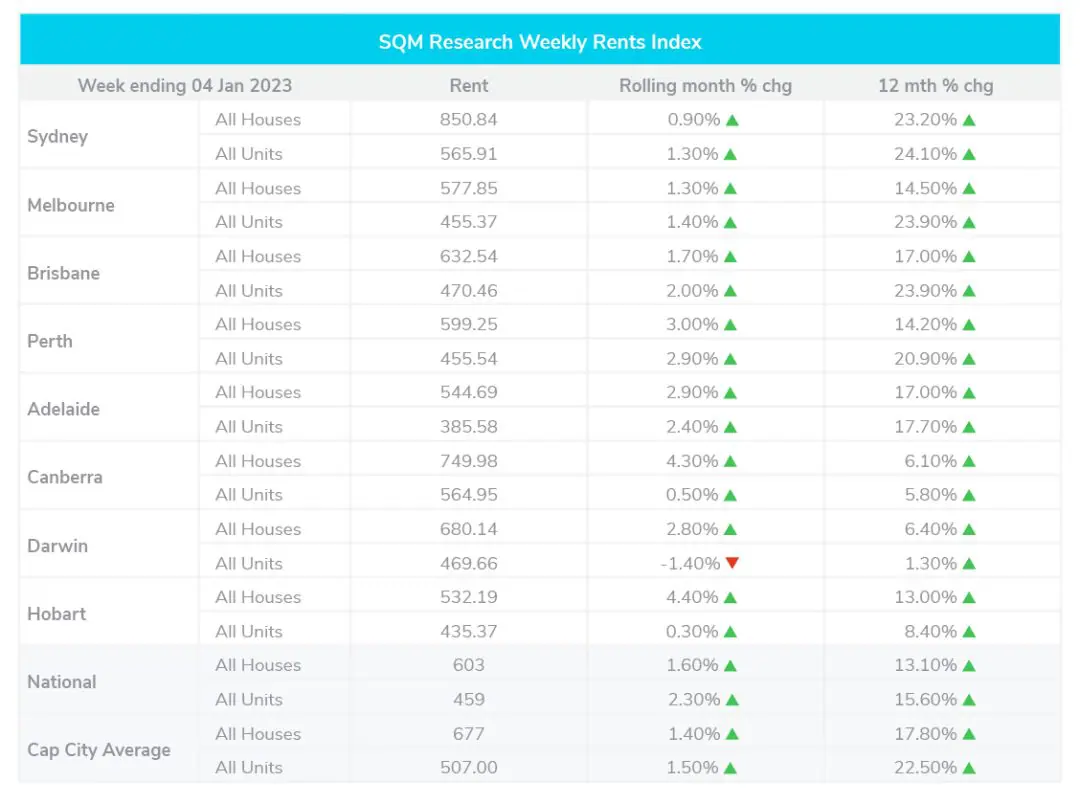

National weekly asking rents increased by 1.6% for houses and 2.3% for units across the previous rolling month, with a 12-month rise of 13.1% for houses and 15.6% for units, a combined 18.7%.

Although the previous month has seen a slower increase across capital city averages than the national figures at 1.6% for houses and 1.5% for units, the overall 12-month rise of 17.8% for houses and 22.5% for units see a combined higher increase than the national average, at 25.7%.

The national median weekly asking rent for a dwelling is recorded at $631 a week for houses and $483 a week for units. Sydney recorded the highest weekly rent for a house at $898.46 a week while Adelaide units offer the best rental affordability of all capital cities at $556.54 a week, followed closely by Hobart at $561.34 a week. Darwin was the only capital city to experience a decrease in weekly asking rents, seen for units only at -1.4%, with weekly asking rent for house prices increasing at 2.8%.

Property prices

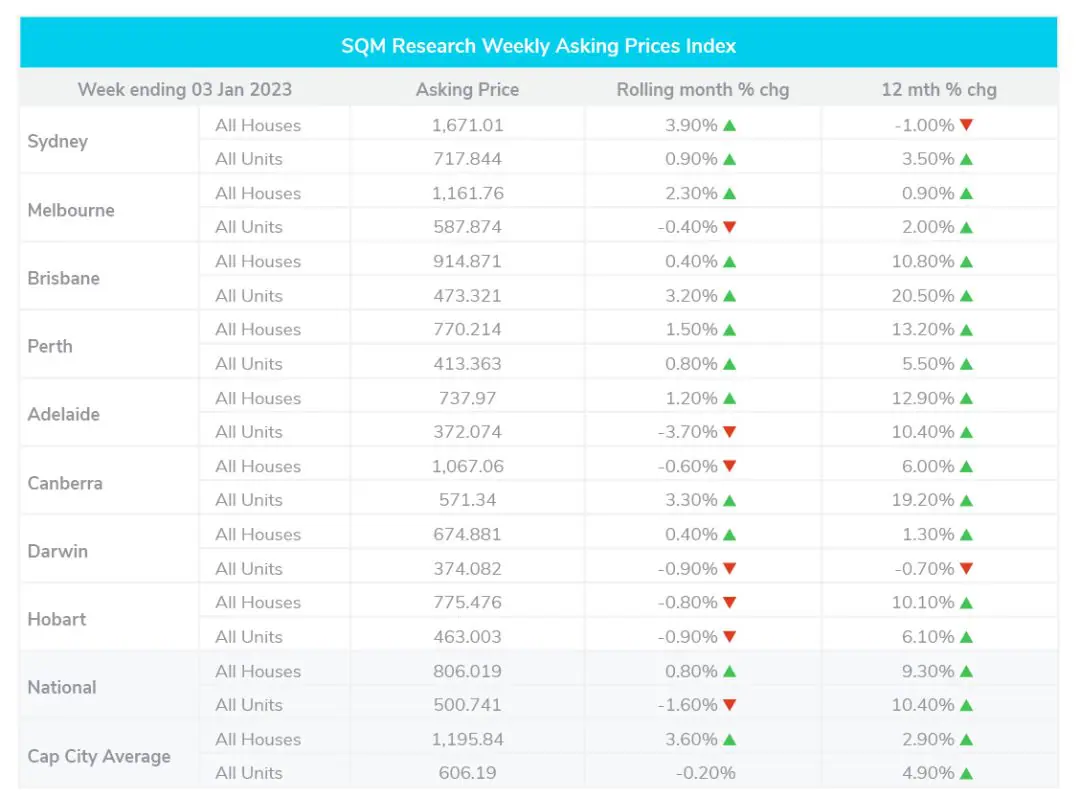

National asking prices increased by 0.8% for houses and decreased by -1.6% for units across the last 30 days. Similarly, capital cities experienced an increase of 3.6% for houses and a decrease of 0.2% for units.

For 12 months to the end of 2022, vendors lifted their dwelling asking prices by 8.2%. Falls recorded in Melbourne and Sydney, were more than offset by rises in all other capital cities and regional townships.

Although Sydney asking prices for houses have seen a 12-month decrease of -1%, the previous month has seen the sharpest increase of all capital cities’ house prices in Sydney at 3.9%, followed by Melbourne at 2.3%. The capital cities experiencing a decrease in asking prices for houses over the past month include Hobart at -0.8% and Canberra at -0.6%.

Cash rate and predictions

December saw the RBA raise the interest rate an additional 0.25 basis point, to a target cash rate of 3.10%.

Article posted by Property Me.