August property market update (2023)

- Posted By Nikki Montaser

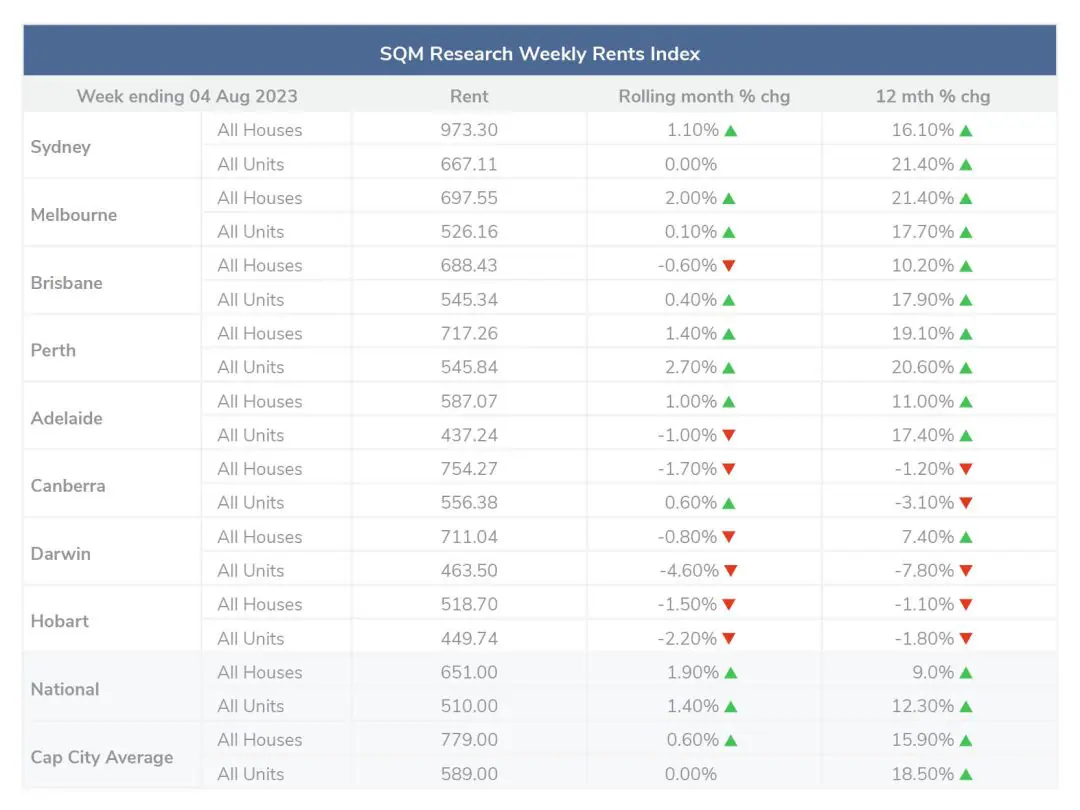

National rental vacancy rates remained steady at 1.3% in July, national rental asking prices increased by 1.9% for houses and 1.4% for units. National total property listings for sale rose in the last 30 days by 2%.

Vacancy rates

National rental vacancy rates remained steady at 1.3% in July while the total number of rental vacancies Australia-wide decreased by 852 dwellings in July for the first time in six months.

Melbourne, Brisbane and Canberra remained steady at 1.3%, 1% and 2.1%,

Across Sydney, Perth, Hobart and Adelaide slight decreases were seen in vacancy rates at 1.6%, 0.5%, 1.7% and 0.6%.

Darwin experienced an increase in vacancy rate to 1.0%.

Louis Christopher, Managing Director of SQM Research said, “After the slight easing in vacancies over the first half of 2023, this is somewhat of a disappointing result for tenants. Clearly, acute rental shortages remain with us. And besides more people grouping together to share the burden, there is no significant solution on the horizon. Where possible I would recommend tenants consider regional areas once again if their employment enables them to work off-site.”

Rental values

Over the past 30 days to 4 September 2023, national asking prices rose by 1.9% for houses and 1.4% for units. The capital city average weekly rent increased by 0.6% for houses with no variations in units.

Compared to last year, the national asking prices increased by 9% for houses and 12.3% for units. The capital city average asking price increased by 15.9% for houses and 18.5% for units.

At 4 September 2023 the national median weekly asking rent for a dwelling is $651 per week for a house and $510 per week for a unit. The median capital city asking rent for a house is $779 per week and $589 per week for a unit.

Minor decreases in weekly asking prices for combined dwellings (both houses and units) were seen in August in Canberra, Darwin and Hobart at -0.6%, -2.7% and -1.8% respectively.

Property prices

National total property listings rose in the last 30 days by 2%, introducing a surge in new listings across most capital cities, with the strongest start to the spring selling season since 2016 for Sydney and Melbourne.

Similarly, national asking prices rose in August by 2.5% for houses with a marginal decrease for units at -0.2%. Compared to the previous 12 months, asking prices have increased by 7.5% for houses and 3% for units.

Compared to August 2022, nationally the market reflected a 4% decrease in new listings, with some regions experiencing a significant decrease for example, North Coast NSW (encompassing Byron Bay) recorded a 12.5% decrease in new listings compared to August 2022.

Across the previous 30 days the capital city average increased by 1.4% in asking prices for houses and decreased by -0.9% for units. Across the previous 12 months, the capital city average asking price increased by 8.1% for houses and 4.3% for units.

Louis Christopher, Managing Director of SQM Research said, “Confidence has been returning at least to our capital city housing markets. The same cannot be said for regional Australia it is best described for most regions as a dead market.

Therefore, we now have two very separate markets in Australia. Firstly, a stronger capital city housing market driven by very strong population growth rates and increasing confidence that we have reached the top of the interest rate cycle. In contrast, regional markets are struggling. Driven by population outflows and uncertainty surrounding local regional economies.”

Cash rate and predictions

August saw the RBA hold the cash rate target at 4.10%.

Disclaimer: The information enclosed has been sourced from SQM Research and Reserve Bank of Australia, and is provided for general information only. It should not be taken as constituting professional advice.

PropertyMe is not a financial adviser. You should consider seeking independent legal, financial, taxation, or other advice to check how the information relates to your unique circumstances.

Article posted by Property Me.