September property market update (2023)

- Posted By Nikki Montaser

National rental vacancy rates fell to 1.2% in August, putting more pressure on the rental housing market in Australia. A significant increase in listings for sale in September, alongside an increase in asking prices marks the strongest September recorded since 2018.

Vacancy rates

National rental vacancy rates fell to 1.2% in August, putting more pressure on the rental housing market in Australia with decreases seen across most regional areas and nearly all capital cities. The total number of vacancies decreased in August by 3,439 properties, bringing the total number of vacancies to 35,425.

Melbourne CBD and Brisbane CBD vacancies increased however to 5.2% and 1.8% respectively, while the Blue Mountains remained steady at 1.5%.

Louis Christopher, Managing Director of SQM Research said, “Over the first half of 2023, there was a mini reprieve for tenants due to a modest lift in rental vacancy rates, especially for our regional townships. However, in more recent months, the rental market has tightened once again. This renewed tightening mostly likely was caused by ongoing and rapid increases in our population plus a decrease in new dwelling completions compared to 2022. Going forward, I expect the low rental vacancy market to be maintained. In response to shortages, housing formation will continue to contract and unfortunately, I am expecting a very large increase in homelessness.”

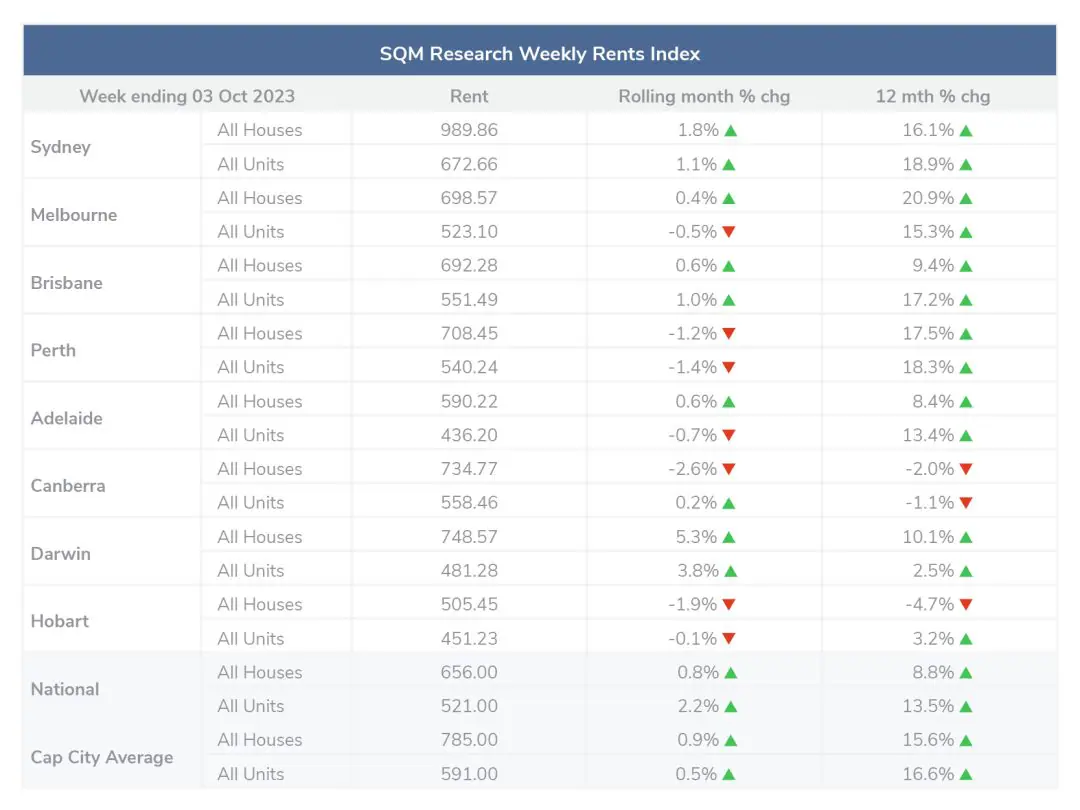

Rental values

Over the past 30 days to 3 October 2023, national weekly asking prices rose by 0.8% for houses and 2.2% for units. The capital city average weekly rent increased by 0.9% for houses and 0.5% for units.

Compared to last year, the national asking prices increased by 8.8% for houses and 13.5% for units. The capital city average asking price increased by 15.6% for houses and 16.6% for units.

At 3 October 2023, the national median weekly asking rent is $656 per week for a house and $521 per week for a unit. The median capital city asking rent for a house is $785 per week and $591 per week for a unit.

Decreases in weekly asking prices for combined dwellings (both houses and units) across the past 30 days were seen in September in Melbourne, Perth, Adelaide, Canberra and Hobart at -0.05%, -1.3%, -0.05%, -1.2% and -1% respectively.

Property prices

National total property listings rose in the last 30 days by a significant 9.3%, attributed primarily to a substantial increase in new listings across capital cities.

For example:

- Sydney’s 12.2% increase in total listings has been driven by a 12.7% increase in new listings

- Melbourne’s 10.5% in total listings has been driven by a 10% increase in new listings

- Canberra’s 16% increase in listings has been driven by a 13.9% increase in new listings

All cities recorded a 7.0% rise in older listings (properties listed for over 180 days).

Distressed listings experienced a slight increase of 1.3%, driven by increases in New South Wales, Victoria, Western Australia and the Australian Captial Territory at 4.0%, 1.5%, 3.6% and 11.1% respectively. Queensland and South Australia bucked this trend with decreases in distressed listings at -1.1% and -2.2% respectively.

National asking prices increased by 0.6% across the past 30 days, with SQM research noting significant surges in Sydney at 1.5% for houses and 2.2% for units. The capital city average asking prices increased by 0.7% for houses and 2% for units.

Louis Christopher, Managing Director of SQM Research said, “The spring selling season is living up to its name once more with a large jump in new listings for September. Nationally, September was the strongest new listings month since April 2022. It was also the strongest September since 2018. The pick-up in new listings is a sign of confidence from vendors that the current market is offering good selling conditions. And while activity has increased in 2023, it is not a boom market by any means.”

Cash rate and predictions

September saw the RBA hold the cash rate target at 4.10%.

Disclaimer: The information enclosed has been sourced from SQM Research and Reserve Bank of Australia, and is provided for general information only. It should not be taken as constituting professional advice.

PropertyMe is not a financial adviser. You should consider seeking independent legal, financial, taxation, or other advice to check how the information relates to your unique circumstances.

Article posted by Property Me.