December property market update (2025)

- Posted By Nikki Montaser

Key points

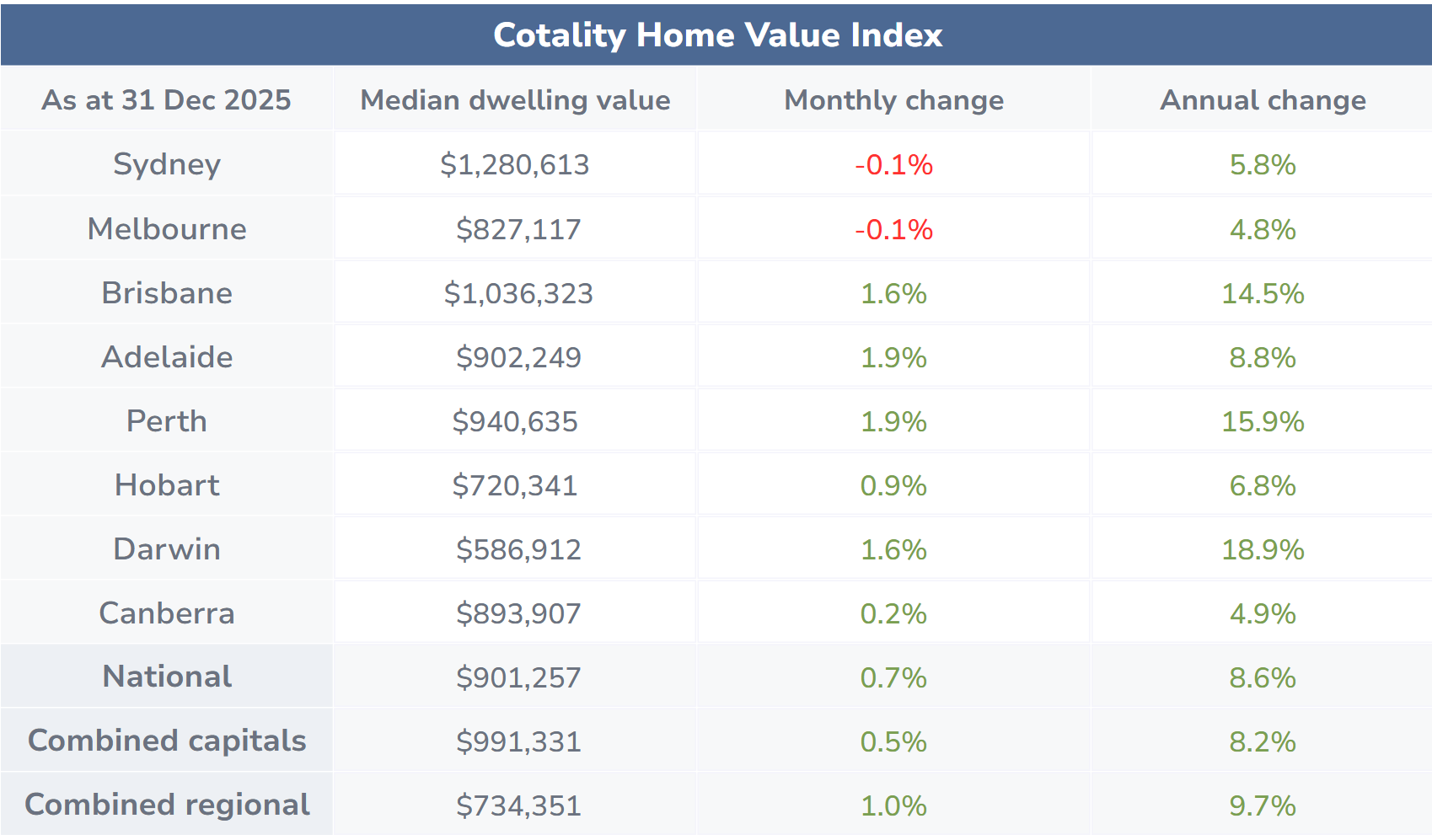

- Property values in Australia increased by 0.7% in December and 8.6% over 2025.

-

Uncertainty around the next cash rate decision and affordability pressures are easing market confidence.

- Demand for affordability is driving growth in regional areas and unit markets.

| Australia’s wealth at a glance | |

| Residential real estate | $12.2 trillion |

| Household wealth held in housing | 55.5% |

| Superannuation | $4.5 trillion |

| Australian listed stocks | $3.5 trillion |

Source: Cotality, RBA, APRA, ASX

Australia’s housing market finished 2025 on a softer note but still delivered strong gains over the year. National home values went up by 0.7% in December, the smallest monthly increase in five months, according to Cotality’s latest data. Over the full year, home values climbed by 8.6%, adding around $71,400 to the national median dwelling price.

Cash rate uncertainty easing growth

While property values in most markets still saw growth, momentum clearly slowed at the end of the year, with interest rate uncertainty and affordability pressures starting to weigh more heavily.

Sydney and Melbourne both declined by -0.1% in December to $1,280,613 and $827,117 respectively. It marks the first monthly fall in Australia’s two largest cities since early 2025.

Every other capital city recorded price growth in December, but the pace generally slowed. Adelaide and Perth led monthly capital city gains, both rising by 1.9%.

The slowdown suggests that there is more caution in the market, with speculation around a potential cash rate increase in 2026. In December, the Reserve Bank of Australia left the cash rate on hold at 3.60% in its last rate decision of the year.

Regional home prices grew faster than capital cities

Regional housing markets outperformed capital cities again in 2025, with stronger house and unit growth recorded across every regional market where data was available. Over the year, regional dwelling values rose by 9.7%, compared with 8.2% across the combined capital cities, reaching $734,351 and $991,331 respectively.

- Regional Western Australia led overall regional growth, with combined dwelling values up by 16.1% ($659,713).

- Regional Victoria recorded the slowest regional growth at 6.0% ($619,697), though values still rose solidly over the year.

- For house values, Regional Western Australia experienced the strongest growth, rising 16.5% over the year to $680,052.

- For unit values, Regional South Australia saw the strongest price growth among regional markets, with values up by 14.3% to $383,009.

Affordable markets drive growth

Affordability continues to shape buyer behaviour, with more affordable markets and home types recording stronger growth. Darwin led annual capital city growth at 18.9%, followed by Perth at 15.9%.

Even though house prices rose faster overall, unit values still increased by 6.0% nationally over the year. Growth was strongest in Perth, where unit prices jumped by 17.5%, and Darwin, where values rose by 17.0%.

By contrast, higher-priced cities such as Sydney and Melbourne delivered the weakest annual results, with combined dwelling values rising 5.8% in Sydney and 4.8% in Melbourne over the year.

It paints a picture of buyers being pushed toward smaller, lower-priced homes in more affordable regions thanks to affordability and borrowing limits, even as overall housing values go up.

Disclaimer: The information enclosed has been sourced from SQM Research and Reserve Bank of Australia, and is provided for general information only. It should not be taken as constituting professional advice.

PropertyMe is not a financial adviser. You should consider seeking independent legal, financial, taxation, or other advice to check how the information relates to your unique circumstances.

We link to external sites for your convenience. We are selective about which external sites we link to, but we do not endorse external sites. When following links to other websites, we encourage you to examine the copyright, privacy, and disclaimer notices on those websites.

Article posted by Property Me.